top of page

The Economic Costs of Refusing Education to Young Girls

Introduction Worldwide, 119 million girls have been denied the basic human right to education. 34 million are of primary school age, 28 million are of lower secondary school age, and 58 million are of upper secondary school age. (Unicef 2025). Girls who receive an education have a higher prospect of earning higher incomes, leading healthier, more productive lives and having the ability to determine factors that may affect them and their future generations. Denying girls the

Diya Jafari

4 min read

Power of Microcredit: the Yellow Brick Road to Financial Inclusion

Introduction 1.4 billion adults are regarded as “unbanked”; they have no account at a financial institution and they do not have access to formal credit or loans (Klapper et al. 2025) [1] . 41% of formal small and medium-sized enterprises (SMEs) have unmet financing needs (World Bank; International Finance Corporation 2022) [2] . In the conventional banking world, there is limited access to loans for small businesses and those who are financially vulnerable. Many small busine

Iman Sheikh

5 min read

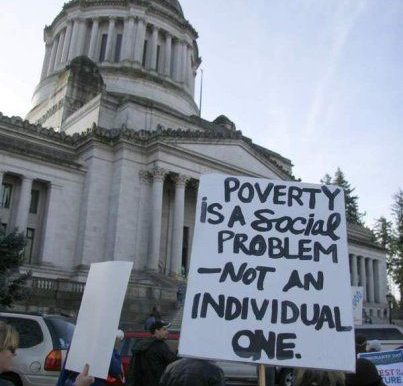

The Welfare Trap: Social Protection or Economic Dependency?

Introduction Economic shocks and changes in the structure of the economy leave many people vulnerable to unemployment and poverty (Erumban and de Vries 2024) [1] . The welfare system was constructed to assist those suffering with poverty and financial instability by raising their quality of life (Federal Safety Net, 2024) [2] . Social benefits were implemented (initially in Germany) with the aim of ensuring the well-being of all citizens by providing them with a social safety

Iman Sheikh

4 min read

Why Is The European Recycling Business Going Extinct?

Introduction In recent years, global warming has become more prominent and acknowledged. Currently burning fossil fuels contributes to 90% of all the carbon dioxide in the environment, the last decade was the warmest 10 years ever recorded in our history and about 11 million tonnes ( sas.org.uk , 2025)[1] , of plastic enters the oceans nearly every year. We are polluting the planet at an alarming rate, which threatens the Earth’s health. In order to combat these overwhelming

Niveditha Pathiyil

6 min read

Global Instability because of De-dollarisation

Introduction In 1944, the US dollar became the world’s primary reserve currency under the Bretton Woods Agreement. Since then, the United States has enjoyed what economists describe as the “exorbitant privilege” of issuing the dominant global currency. However, in recent years, this dominance has come under increasing pressure as countries pursue de-dollarisation strategies. While often framed as a means of reducing dependence on the United States, these efforts may generate

Josh Mcfadden

8 min read

Emergency Spending Trap: Climate Change and Rising National Debt

Developing countries have been falling deeper and deeper into the vicious cycle of climate change. They have found themselves in an emergency spending trap, where they are suddenly diverting key fiscal resources into restoring the nation after frequent natural disasters. As a result, economic growth is halted and many countries turn to high-interest loans to manage the crisis, further exacerbating these countries’ resource deficits. Year after year, developing countries face

Iman Sheikh

4 min read

Cryptocurrency: Can It Pierce Through Exclusion in America’s Financial System?

What happens when racially biased judgments persist within America’s banks? They perpetuate systemic distrust and suppress the economic growth of people of color (POC), forcing many to rely on costly, bank-bypassing services like check-cashing stores—fees that can total nearly $40,000 over a working lifetime. Such outcomes reflect not individual failure but institutional design: a centralized, discretionary, and diversity-lacking financial system that continues to exclude. Em

Albert Gorani

6 min read

Profit Over People: How Financialization Impacted the UK Housing Market

Introduction The shortage in housing in England has been persistent since the 1980s. It has become more acute in the years since 2010 due to reasons like the decline and demolition of social housing and reductions in capital investment for new affordable housing. However this is not solely a logistical problem but a deeper market failure driven by market financialization, that exaggerates other socioeconomic issues like poverty or income inequality. The Problem The core issue

Niveditha Pathiyil

5 min read

bottom of page